iBond ProX

Safe Investment, Peaceful Living

As Vietnam’s corporate bond market moves toward a more sustainable growth phase, TCBS understands investors’ growing demand for safety and reliability.

That’s why we have continuously enhanced our bond offerings and introduced iBond ProX — a product designed with superior protection and liquidity assurance.

When investing in iBond ProX, clients enjoy all the benefits of the Sustainable Accumulation or Flexible Investment bond packages, along with TCBS’s exclusive brokerage service that helps investors recover full principal and interest in the event the issuer fails to make payments at maturity.

This means your principal and interest are fully protected, ensuring complete peace of mind.

Why invest in iBond ProX ?

How iBond ProX protects investors

Full Principal and Interest ProtectionIf, within 10 business days after bond maturity (T+10), the issuer fails to repay, TCBS will broker the sale of your bonds to recover both principal and interest by T+20. If the bonds remain unsold after T+20, TCBS will continue to fulfill its brokerage obligation until you have successfully sold all your iBond ProX holdings.

Early Exit Option for Bonds Showing Risk SignalsTDuring the holding period, TCBS continuously monitors each bond. If signs of covenant breaches or potential default arise, TCBS will notify investors and initiate early brokerage assistance to sell the bonds before maturity.

TCBS will continue its brokerage duty until all iBond ProX bonds are sold successfully. Case 2: If the investor declines to sell

The iBond ProX brokerage agreement will automatically terminate at that time.

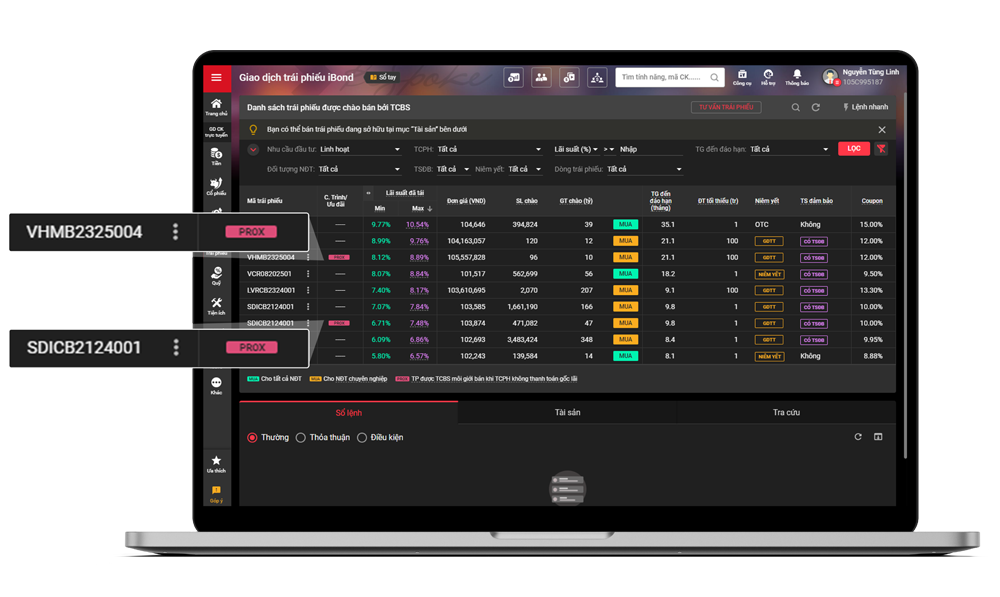

How to Trade iBond ProX

Investors can easily buy or sell bonds labeled “ProX” in the Bond Order section on TCInvest, following the same simple steps as with standard iBond products.

FAQs about iBond ProX

Question 1: At what price will TCBS broker the resale of my bonds?

TCBS will broker the bond resale for the client at a Unit Price calculated as follows: Unit Price = Face Value of the bond + Accrued interest from unpaid coupon periods up to the transaction date

Example: The client has not yet received the principal of VND 100 million on the bond maturity date of 01/09/2023, and the coupon for the period 01/06/2023 – 01/09/2023 carries an interest rate of 9%/year. If TCBS successfully brokers the bond resale for the client on 15/09/2023, the resale Unit Price will be: Unit Price = Face Value + (90 days / 365 days × 9% × Face Value) + (14 days / 365 days × 9% × Face Value)

Notes:

The client is responsible for paying applicable taxes and program participation fees:

- Personal Income Tax (for individual investors): 0.1% of the selling price, or the applicable tax rate effective at the time of transfer.

- Program Participation Fee: As prescribed by TCBS from time to time, but not exceeding 0.15% of the selling price.

Question 2: Until when does TCBS maintain its bond brokerage obligation?

TCBS’s brokerage obligation under the signed contract with the client will remain in effect until one of the following events occurs:

- TCBS has successfully brokered the sale of all bonds requested by the client, as stated in the valid and timely Bond Sale Notice under the brokerage contract; or

- The client voluntarily waives the right to brokerage services under the signed Bond Sale Notice, and TCBS approves such waiver; or

- The bonds reach maturity and the issuer has fully repaid principal and interest to the client; or

- The client accepts alternative repayment options for the bonds as proposed by the issuer.

Ready to invest in iBond with TCBS?

Step 1: Open an Online Account in Just 3 Minutes

Customers can open a securities account online via the TCInvest website: https://tcinvest.tcbs.com.vn/

Step 2: Place Bond Orders Online

Select the iBond or iConnect section to place your bond orders.