iFund – Investment Funds

iFund is an investment solution comprising open-ended funds and ETFs, professionally managed by experienced fund managers. With a minimum investment starting from just VND 10.000, iFund makes it easy for everyone to access professional investment products.

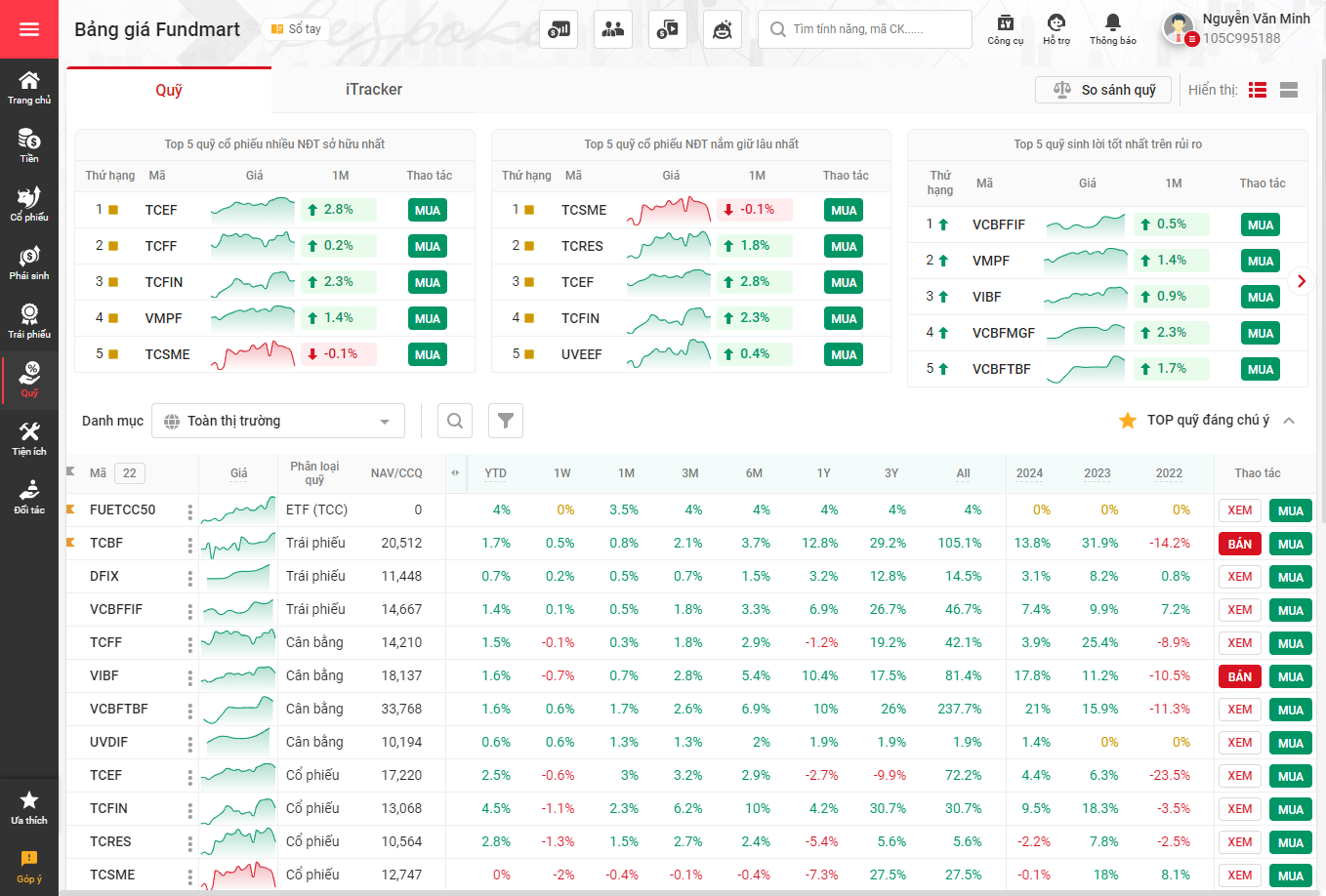

The iFund product portfolio is diverse and tailored to each investor’s financial goals and risk appetite. All transactions are conducted online via TCBS’s Fundmart platform, allowing investors to manage their portfolios conveniently and efficiently.

Exchange Traded Fund (ETF)

An Exchange-Traded Fund (ETF) replicates a specific market index and can be traded flexibly on the stock exchange, allowing investors to own a diversified portfolio through a single transaction.

ETF Techcom Capital VNX50 (FUETCC50)

The Techcom Capital VNX50 ETF (FUETCC50) offers investors exposure to the 50 leading listed companies in Vietnam’s stock market. It features low management fees, high liquidity, and a transparent portfolio, making it an optimal solution for both individual and institutional investors seeking diversification and growth opportunities in Vietnam’s economy.

However, the fund carries a higher level of risk as its performance fluctuates in line with the VNX50 Index and broader domestic and global market conditions.

Open-ended Investment Fund

Open-ended funds are professionally managed to help investors easily participate in the securities market through a safe and flexible investment portfolio.

Techcom Bond Fund (TCBF)

TCBF allows individual investors to invest alongside Techcom Capital in Vietnam’s highest-quality corporate bonds, certificates of deposit, and treasury bills, aiming to generate stable long-term income.

The fund targets expected returns higher than the 12-month average savings rate, with earnings realized over the investment period.

Techcom Equity Fund (TCEF)

TCEF offers investors the opportunity to own shares of Vietnam’s leading listed companies, aiming for long-term returns approximately twice the 12-month average savings rate. The fund carries a high-risk level, as its performance is subject to annual fluctuations driven by stock market volatility and broader domestic and global economic conditions.

Techcom Balanced Flexi Fund (TCFF)

TCFF primarily invests in securities (stocks, bonds, etc.) of industry-leading companies or those with strong long-term growth potential, attractive valuations, or high and stable yields.

It targets long-term expected returns about 1.5 times the 12-month average savings rate, with earnings realized over the investment horizon. The fund has a medium risk level.

Techcom Banking and Finance Equity Fund (TCFIN)

TCFIN Fund helps investors own shares of leading companies operating in the Banking and Financial Services sector on the Vietnam stock exchange with expected long-term profits expected to be 2 times the average 12-month savings interest rate, received over the investment period. This is a very important economic sector and goes hand in hand with the development of the Vietnamese economy, the capitalization of listed companies accounts for nearly 40% of the total capitalization of the VN-Index.

Techcom Real Estate Equity Fund (TCRES)

TCRES Fund helps investors own shares of leading companies operating in the real estate and construction materials sector on the Vietnamese stock market with expected long-term profits expected to be twice the average 12-month savings interest rate, actually received over the investment period. The real estate, construction and construction materials sector is an important economic sector of the country, with good long-term growth potential, based on: Vietnam is entering a period of golden population structure; rapid growth in per capita income with an increasing middle class; expectations of accelerating urbanization in the future,…

Small and Medium Enterprise Equity Fund (TCSME)

TCSME Fund helps investors own shares of leading enterprises in the midcap and smallcap groups in the Vietnamese stock market with expected long-term profits expected to be twice the average 12-month savings interest rate, received over the investment period. The characteristic of this group of stocks is moderate capitalization, some companies may have leading positions in niche markets or have distinct competitive advantages. This is expected to bring higher growth potential than large-cap stocks (bluechip), but also comes with a high risk of short-term price fluctuations. Therefore, the investment process requires professional management by the fund management team to balance the expected rate of return and the level of risk, in order to optimize benefits for investors.

DC Dividend Focus Equity Fund (DCDE)

DCDE – DC Dividend Focus Equity Fund is a pioneer open-ended fund in Vietnam aiming at annual cash income for investors from dividends, while preserving and growing long-term capital.

DC Dynamic Securities Fund (DCDS)

DCDS – DC Dynamic Securities Fund is the first growth stock fund in Vietnam, with more than 20 years of operation and is always in the group of funds with leading investment efficiency in the market.

United ESG Vietnam Equity Fund (UVEEF)

UVEEF focuses on investing in leading companies across key industries that possess strong fundamentals, solid financial positions, and high growth potential. The fund targets businesses that meet rigorous Environmental, Social, and Governance (ESG) standards, thereby enhancing their long-term sustainable competitiveness.

UVEEF aims to deliver superior medium- to long-term returns for investors, with a moderate level of risk relative to the overall market. The fund is managed by UOB Asset Management (Vietnam) JSC.

United Vietnam Dynamic Income Fund (UVDIF)

The investment objective of the United Vietnam Dynamic Income Fund (UVDIF) is to seek both regular periodic income and long-term capital growth by building a diversified portfolio of fixed income assets and high-quality equities. The Fund also aims to pay dividends annually. UOBAM Group always considers sustainable returns as the top criteria in investment management activities. The UVDIF Fund aims to build a diversified portfolio and dynamically allocate assets according to the macro and market situation to take advantage of investment opportunities.

Mirae Asset Vietnam Growth Equity Fund (MAGEF)

Mirae Asset Vietnam Growth Equity Fund (MAGEF) actively invests in listed stocks, stocks registered for trading with large capitalization, high liquidity and stocks that will be listed and registered for trading on the Vietnamese stock market. MAGEF Fund is managed by Mirae Asset Fund Management Company Limited (Vietnam) and supervised by Standard Chartered Bank Limited (Vietnam).

VinaCapital Insights Balanced Fund (VIBF)

VinaCapital Insights Balanced Fund (VIBF) is a balanced open-ended fund professionally managed by VinaCapital, investing in a balance between stocks and bonds to help investors access stocks with good growth potential while minimizing the risk of market fluctuations through investing in bonds. VIBF Fund invests mainly in securities (stocks, bonds, etc.) of leading companies or those with good long-term growth potential, securities with attractive valuations or securities with high, stable returns to create a source of optimal medium- and long-term returns. Investors can trade daily with a minimum investment of VND 100,000, so the Fund’s liquidity and flexibility are very high.

VinaCapital Equity Special Access Fund (VESAF)

VinaCapital Equity Special Access Fund (VESAF) is a professionally managed equity fund by VinaCapital, investing in listed stocks of small and medium capitalization enterprises, and stocks with limited foreign room. VESAF is suitable for medium and long-term investment. Investors can trade daily with a minimum investment of VND 100,000, so the Fund’s liquidity and flexibility are very high.

VinaCapital Modern Economy Equity Fund (VMEEF/VMPF)

VinaCapital Modern Economy Equity Fund (VMEEF/VMPF) is a fund that invests in stocks associated with the long-term economic development drivers in Vietnam. The fund is suitable for medium- and long-term investment. Investors can trade daily with a minimum investment of VND 100,000, so the liquidity and flexibility of the Fund are very high.

VinaCapital Equity Opportunity Fund (VEOF)

VinaCapital Equity Opportunity Fund (VEOF) is a fund that invests in large-cap stocks and stocks representing industries. The fund is suitable for medium- and long-term investment. Investors can trade daily with a minimum investment of VND 100,000, so the Fund’s liquidity and flexibility are very high.

DFVN Capital Appreciation Fund (DCAF)

DCAF Fund aims to grow the capital and assets of Investors, striving to exceed the growth rate of the Vietnam Stock Market (VN-Index) in the long term, by investing mainly in stocks listed on the Vietnam Stock Market. Investors can trade daily with a minimum investment of 100,000 VND, so the liquidity and flexibility of the Fund are very high.

DFVN Fixed Income Fund (DFIX)

Quỹ DFIX hướng tới mục tiêu tăng trưởng bền vững trong trung và dài hạn thông qua việc đầu tư vào các tài sản thu nhập cố định có chất lượng tín dụng tốt. Quỹ phù hợp cho đầu tư trung dài hạn. Nhà đầu tư có thể giao dịch hàng ngày với mức đầu tư tối thiểu là 100.000 đồng, nên tính thanh khoản và linh hoạt của Quỹ rất cao.

VCBF Fixed Income Fund (VCBFFIF)

VCBF Fixed Income Fund (VCBF-FIF) assets are invested up to 100% in bonds with good credit quality. VCBF-FIF will mainly invest in a diversified portfolio of fixed income assets, mainly Government bonds, Government-guaranteed bonds, local government bonds and high credit quality corporate bonds. Reference yield: 10-year Government bond yield.

VCBF Active Income Fund (VCBFAIF)

The VCBFAIF fund pursues a value investment strategy. In addition to the opportunity to increase asset value through stock price increases, the Fund focuses on creating a stable income stream by selecting businesses with a regular and sustainable dividend policy.

VCBF Tactical Balanced Fund (VCBFTBF)

VCBF Tactical Balanced Fund (VCBF-TBF) assets are flexibly invested according to a defensive or growth investment strategy depending on the investment opportunities available at different times. Under normal market conditions, the fund will invest 50% of its value in stocks and 50% in fixed income assets with good credit quality. VCBF-TBF Fund invests in a diversified portfolio of listed and registered stocks with large and medium market capitalization on HSX and HNX; Vietnamese Government bonds, local government bonds, Government-guaranteed bonds, or listed bonds of enterprises with good credit ratings. Reference return: Average change of VNIndex and 10-year Government bond yield.

VCBF Midcap Growth Fund (VCBFMGF)

VCBF Midcap Growth Fund (VCBFMGF) assets are invested up to 100% in stocks of companies with medium capitalization and high growth potential. VCBF-MGF will mainly invest in a diversified portfolio of listed stocks with medium market capitalization and high growth potential on HSX and HNX. Stocks considered to have medium market capitalization are those in the VNMIDCAP basket.

VCBF Blue Chip Fund (VCBFBCF)

VCBF Blue Chip Fund (VCBF-BCF) is invested up to 100% of its value in stocks with large market capitalization and good liquidity. VCBF-BCF Fund will mainly invest in a diversified portfolio of listed stocks with large market capitalization and good liquidity. Stocks are considered to have large market capitalization if their market capitalization is greater than or equal to the market capitalization of the smallest capitalized stock in the VN30 index basket of HSX.

SSI Sustainable Competitive Advantage Open-ended Fund (SSISCA)

The SSISCA Fund’s investment objective is to increase long-term net asset value and generate stable income for investors through investing in stocks of companies with sustainable competitive advantages and fixed income assets.

The Fund will apply an active investment strategy, focusing on investing in a portfolio of listed stocks of companies with sustainable competitive advantages, large market share, good management capacity, strong financial situation, ability to operate well in unfavorable market conditions, and are attractively priced compared to the company’s future growth potential.

The Fund will also invest in fixed income assets with good credit quality, ensuring capital recovery and bringing fixed income to the Fund.

Phu Hung Vietnam Select Investment Fund (PHVSF)

The first open-ended fund established and managed by Phu Hung Fund Management Joint Stock Company, ensuring operations according to international standards of investment analysis, risk management and trading. Along with professional investment strategies, PHVSF invests in many types of securities spread across diverse industries/organizations, bringing investors profits with high growth and meeting long-term goals.

NTP Equity Prospect Open-ended Fund (NTPPF)

NTP Equity Prospect Open-ended Fund (NTPPF) is the first public fund managed by NTP Fund Management Joint Stock Company (NTP AM), for domestic and foreign individual and institutional investors. The Fund’s investment objective is to increase long-term net asset value and sustainable income for investors based on analysis, evaluation, and selection of good quality assets combined with reasonable portfolio allocation and proactive risk minimization for investors.

VinaCapital Dynamic Dividend Equity Fund (VDEF)

VinaCapital Dynamic Dividend Equity Fund (VDEF) is an open-ended equity fund professionally managed by VinaCapital. The Fund aims to bring stable asset growth to investors in the medium and long term, through investing in listed companies with solid business models, healthy cash flow and finances demonstrating the ability to pay high dividends in the long term. The Fund will apply a proactive investment strategy, focusing on investing in a portfolio of listed stocks of companies with sustainable competitive advantages, large market share, good management capacity, strong financial situation, the ability to operate well in unfavorable market conditions, and are attractively priced compared to the company’s future growth potential.

The Fund will also invest in fixed income assets with good credit quality, ensuring capital recovery and bringing fixed income to the Fund.

Why you should investing in iFunds

Ready to start investing in iFunds with TCBS?

Step 1: Open TCBS Securities account in 3 minutes

Open a securities account online via the TCBS website. https://tcinvest.tcbs.com.vn/

Step 2: Place your fund orders online

After logging in to TCInvest, simply select the Fundmart price board to view and choose the investment fund that best suits your financial goals.