iBond Protect

Security You Can Trust, Flexibility You Deserve

Understanding that capital preservation and steady growth are top priorities for investors — especially amid today’s dynamic financial markets — Techcom Securities (TCBS) proudly introduces iBond Protect, a premium bond product offering four layers of protection and superior safety features.

iBond Protect retains all the advantages of standard iBond products while going further — featuring a payment guarantee from Techcombank, ensuring investors receive full principal and interest under all circumstances.

This innovation provides peace of mind, addresses one of investors’ greatest concerns — repayment risk — and supports the sustainable growth of a transparent, reliable, and efficient bond market in Vietnam.

Currently, iBond Protect bonds are available in a range of maturities from 1 to under 3 years, designed to meet diverse investment preferences.

4 Layers of Safety Protection with iBond Protect

iBond Protect Product Lines Offered by TCBS

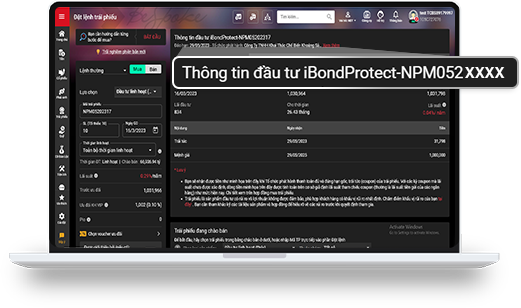

iBond Protect Prix: Retains all features of the standard iBond Prix, while enhanced with Techcombank’s payment guarantee for all principal and interest payments from the issuer.

Bond codes follow the format iBondProtect-XXXXX (where XXXXX is the specific bond code).

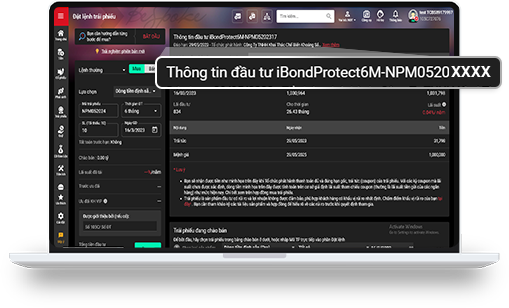

iBond Protect Pro: Based on the standard iBond Pro product, includeing Techcombank’s payment guarantee for all scheduled payments.

Bond codes follow the format iBondProtect6M-XXXXX, iBondProtect9M-XXXXX, etc.,

where “6M” or “9M” indicates the investment tenor of 6 or 9 months.

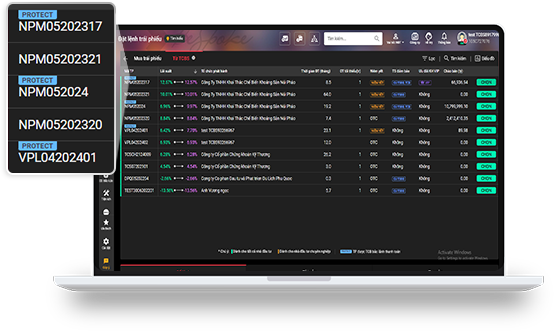

How to trade iBond Protect

Investors can easily buy or sell bonds labeled “Protect” in the Bond Order section on TCInvest, following the same simple steps as with standard iBond products.

FAQs about iBond Protect

Question 1: If I do not receive the bond’s principal or interest payments, what should I do to claim them, and how long will it take?

If a bondholder does not receive the principal or interest payment on the due date, they may submit a written notification to TCBS — the Bondholders’ Representative — on the following business day. TCBS will then coordinate directly with the Issuer and the Guarantor Bank (Techcombank) to ensure the unpaid principal and/or interest are promptly settled to the bondholder.

The bondholder will receive the outstanding payment within approximately 7 to 35 working days from the original due date of the payment. In addition, the bondholder will also receive interest compensation for the delayed payment period.

Question 2: Since iBond Protect is guaranteed by Techcombank, can it be considered the same as a savings deposit?

No. iBond Protect is an investment product, not a savings deposit.

However, it offers the highest level of safety among bond products in the market thanks to Techcombank’s payment guarantee. Because of this, the expected investment return of iBond Protect is higher than Techcombank’s deposit rates, yet slightly lower than the returns from other non-guaranteed corporate bonds distributed by TCBS.

Ready to invest in iBond with TCBS?

Step 1: Open an Online Account in Just 3 Minutes

Customers can open a securities account online via the TCInvest website: https://tcinvest.tcbs.com.vn/

Step 2: Place Bond Orders Online

Select the iBond or iConnect section to place your bond orders.