iConnect – Online Bond Trading Platform

First and Only in the Market

iConnect is Vietnam’s largest online bond trading platform by transaction volume.

Developed by TCBS – the market leader in corporate bond advisory and distribution, iConnect is the first and only platform in Vietnam that fully meets the online bond trading and investment needs of both individual and institutional clients, delivering an optimized and seamless bond trading experience for investors.

Challenges Faced by Investors when invest in Corporate Bonds

iConnect — Solving Every Challenge for Bond Investors

Flexible and Easy Liquidity

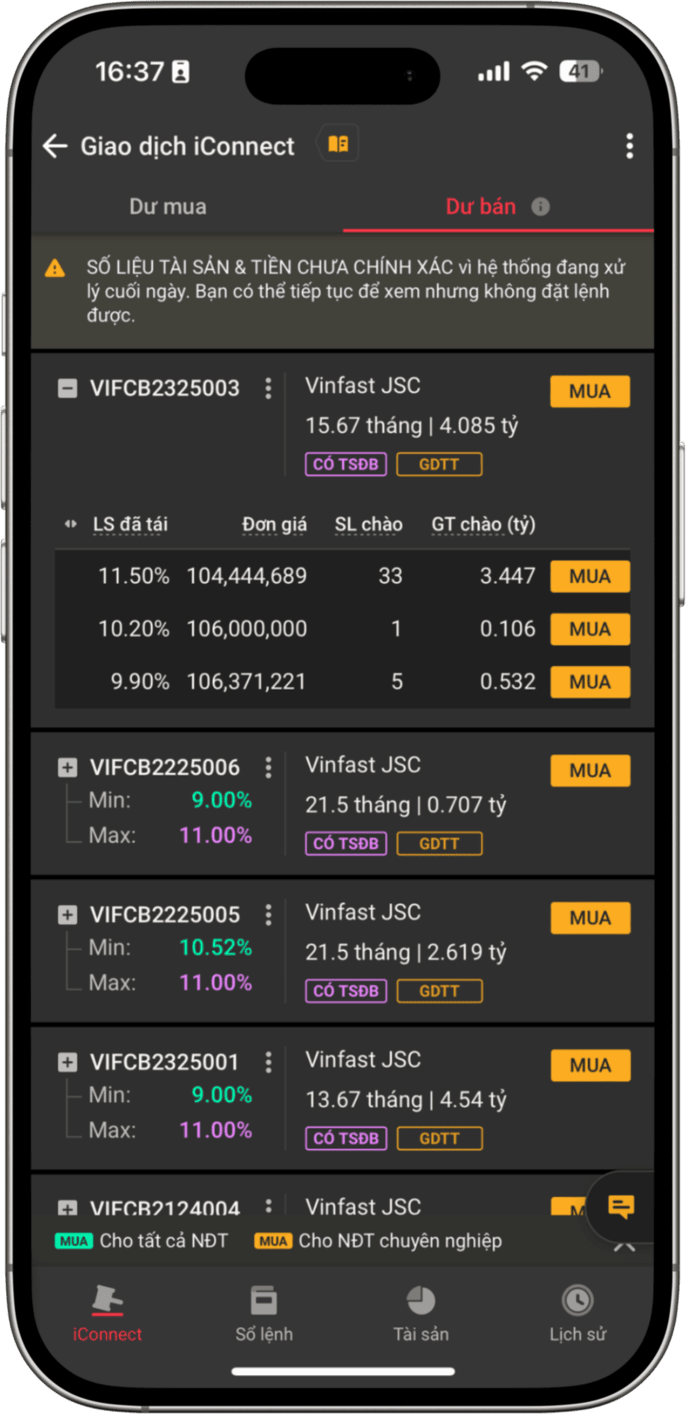

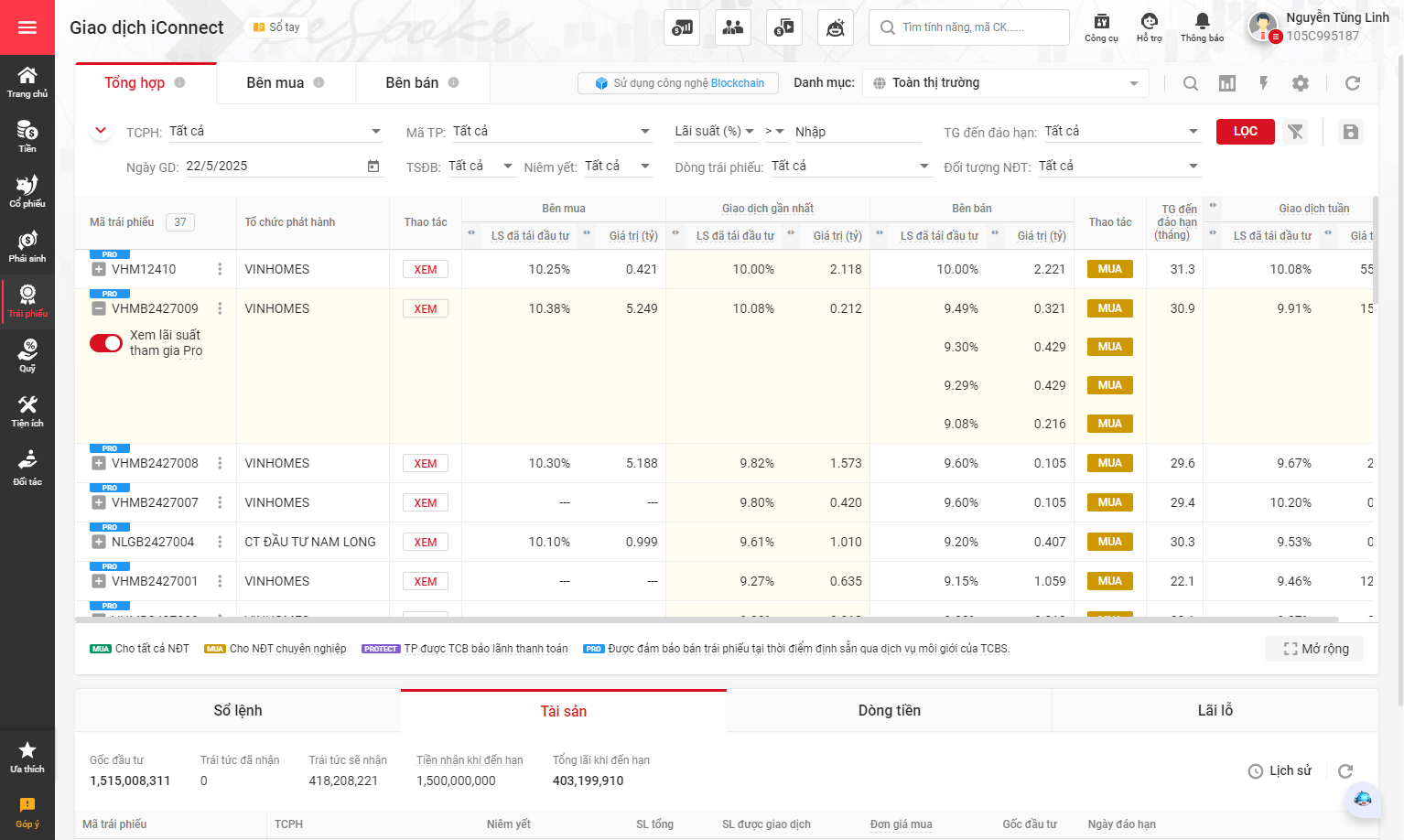

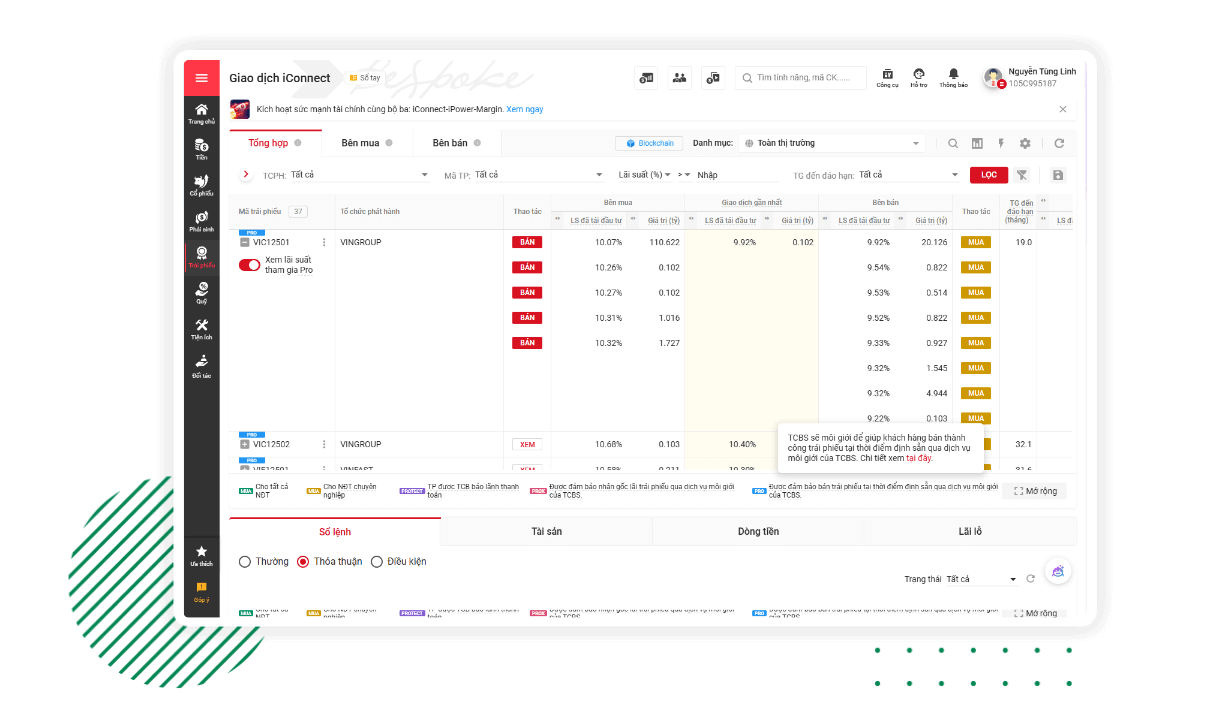

Both individual and institutional investors can easily search for bonds that meet their needs and sell them at any time before maturity directly on iConnect, ensuring maximum flexibility and convenience.

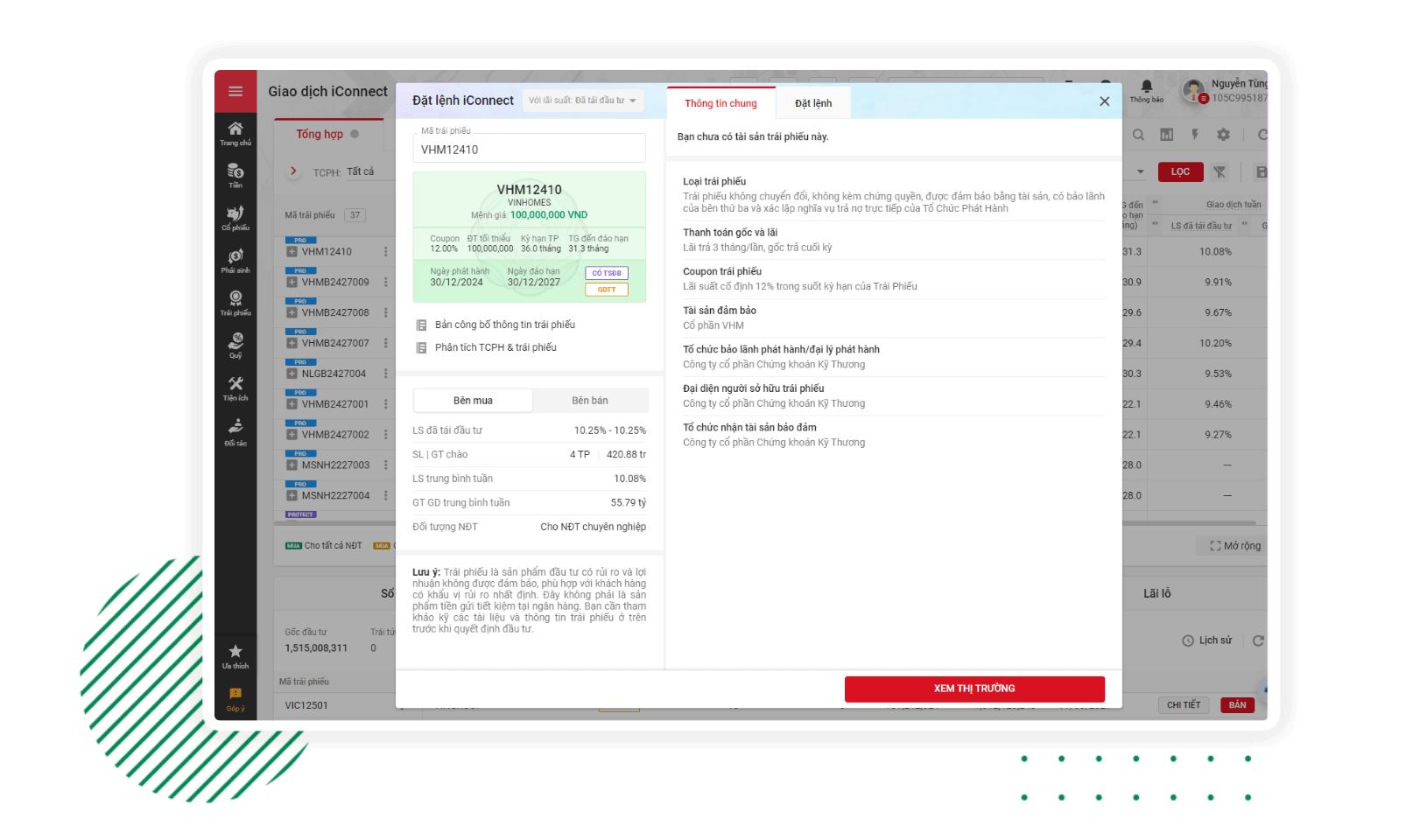

Transparent Information

iConnect provides clear and comprehensive information for each bond, including interest rate, maturity date, and the issuer’s financial status — helping investors easily track and make informed decisions.

All bonds traded on iConnect are carefully screened, appraised, and risk-managed under the strict investment assessment procedures of TCBS and Techcombank.

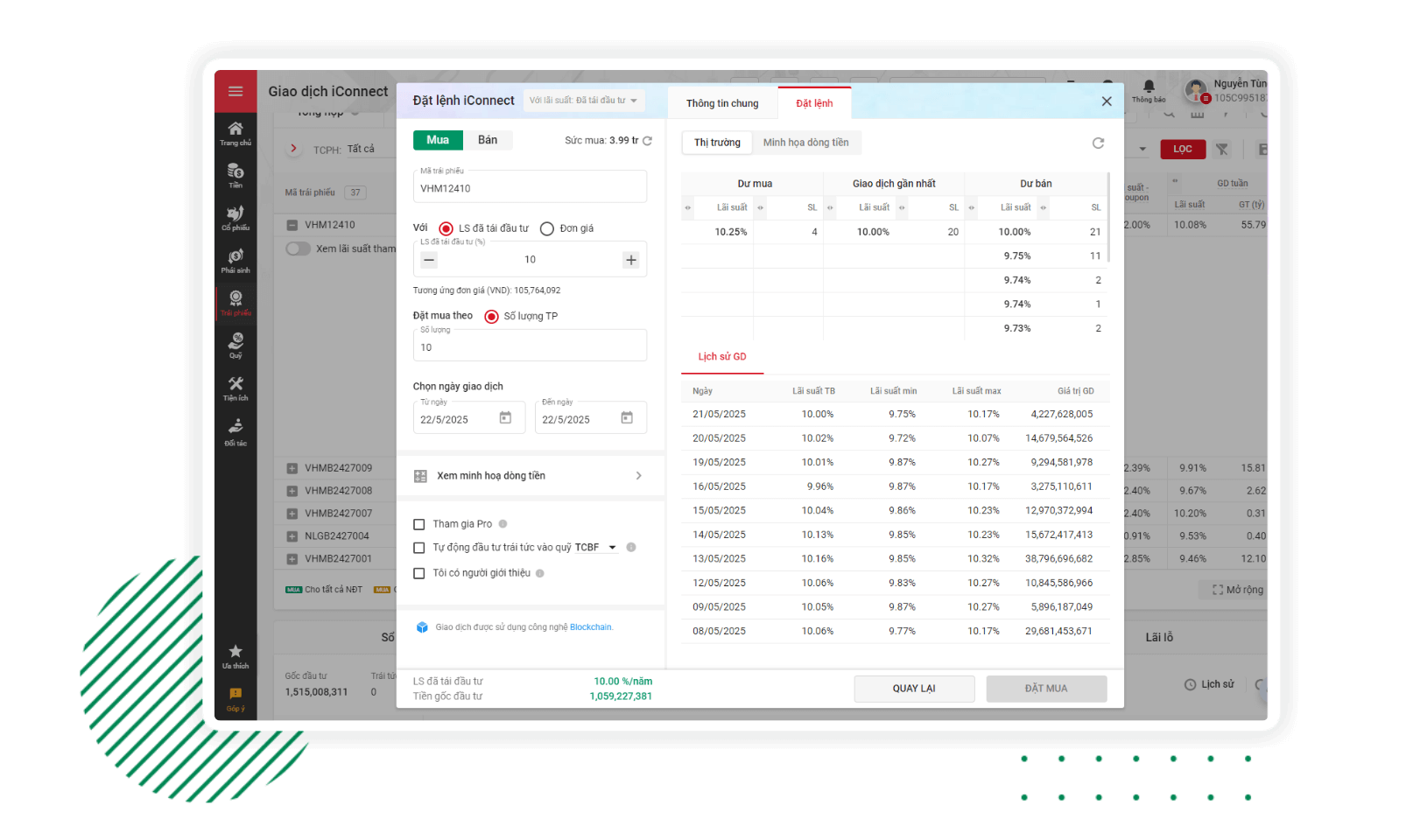

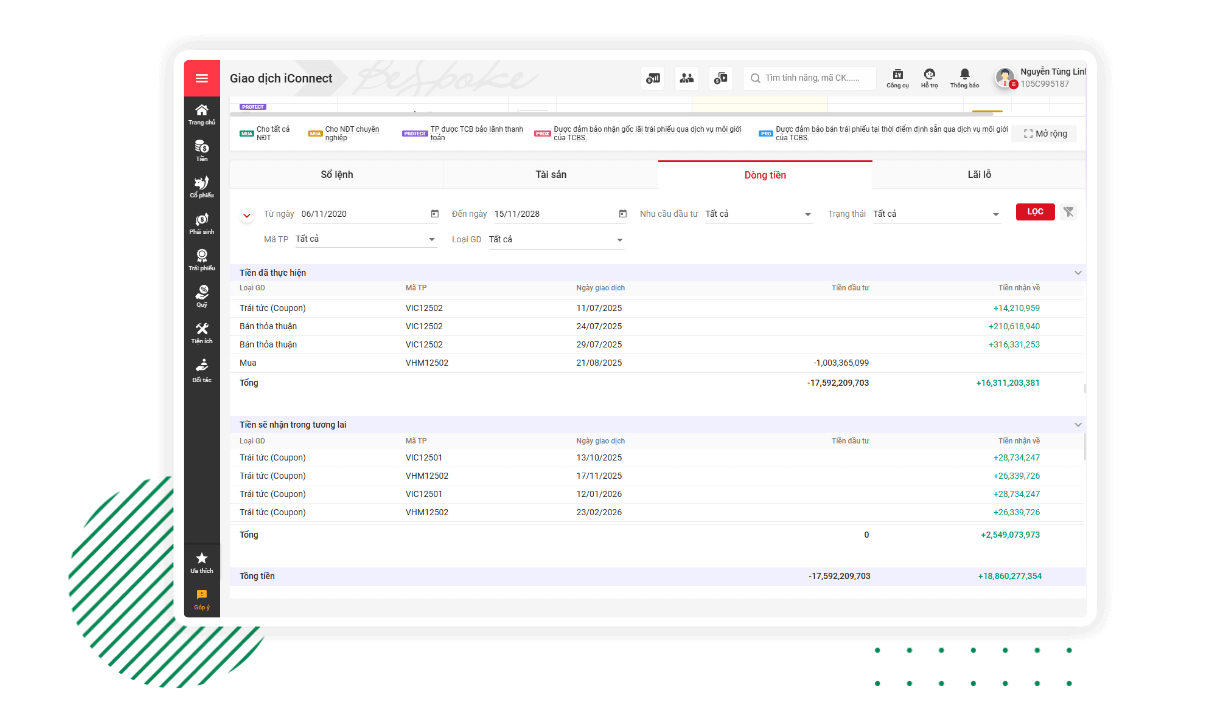

Clear and Intuitive Cash Flow Visualization

Easily track and visualize your expected cash flow throughout the entire investment journey:

- Holding to Maturity: iConnect provides a detailed projection of principal and coupon payments based on current reference interest rates, even for future coupon periods with undetermined rates.

- Early Redemption: Cash flows are illustrated clearly, enabling you to proactively calculate potential proceeds and make liquidity decisions anytime.

All information is transparent, visual, and easy to follow, helping you stay in control of your financial plan at all times.

View guide

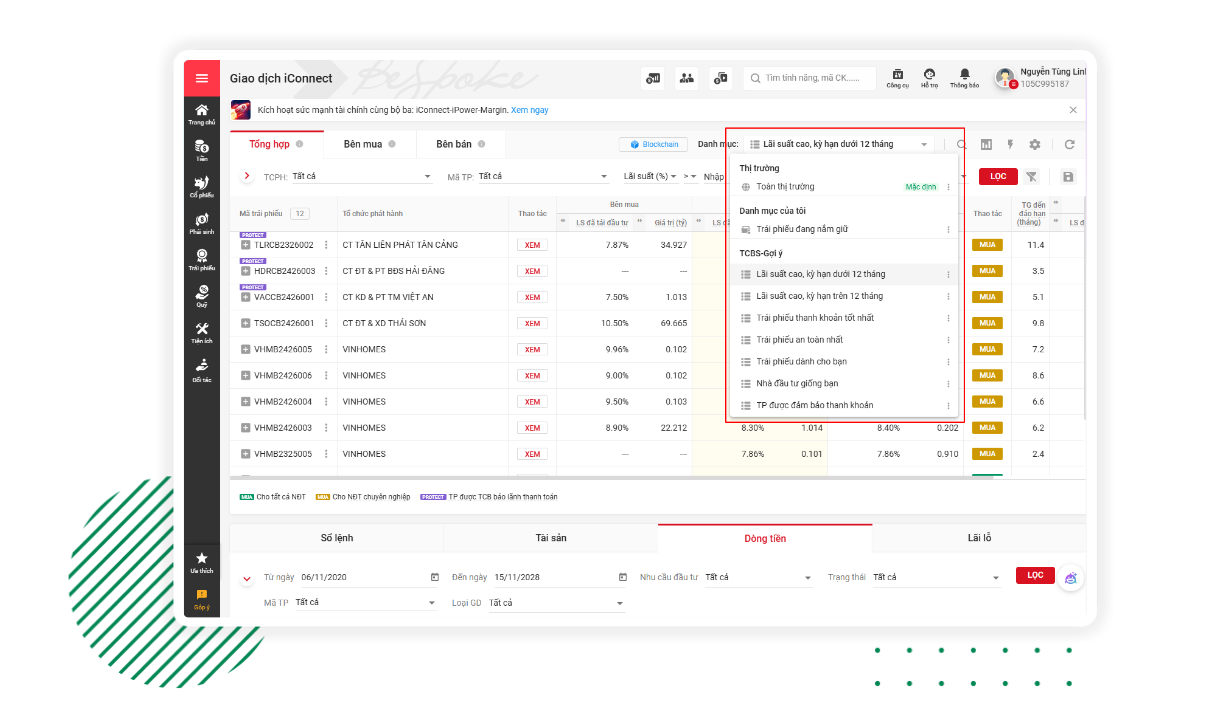

TCBS Bond Portfolio Recommendation

No more time-consuming bond selection. The TCBS Smart Recommendation feature suggests a tailored investment portfolio that best fits your personal preferences — all with a single tap.

Powered by AI technology, the system automatically analyzes and proposes investment criteria, including:

- High-yield bonds to maximize returns

- Flexible tenors (above/below 12 months) for different saving and investment needs

- Secure, liquid bonds — carefully screened and evaluated by TCBS and Techcombank for ease of resale

- “Investors Like You” recommendations — based on real investment behavior and preference

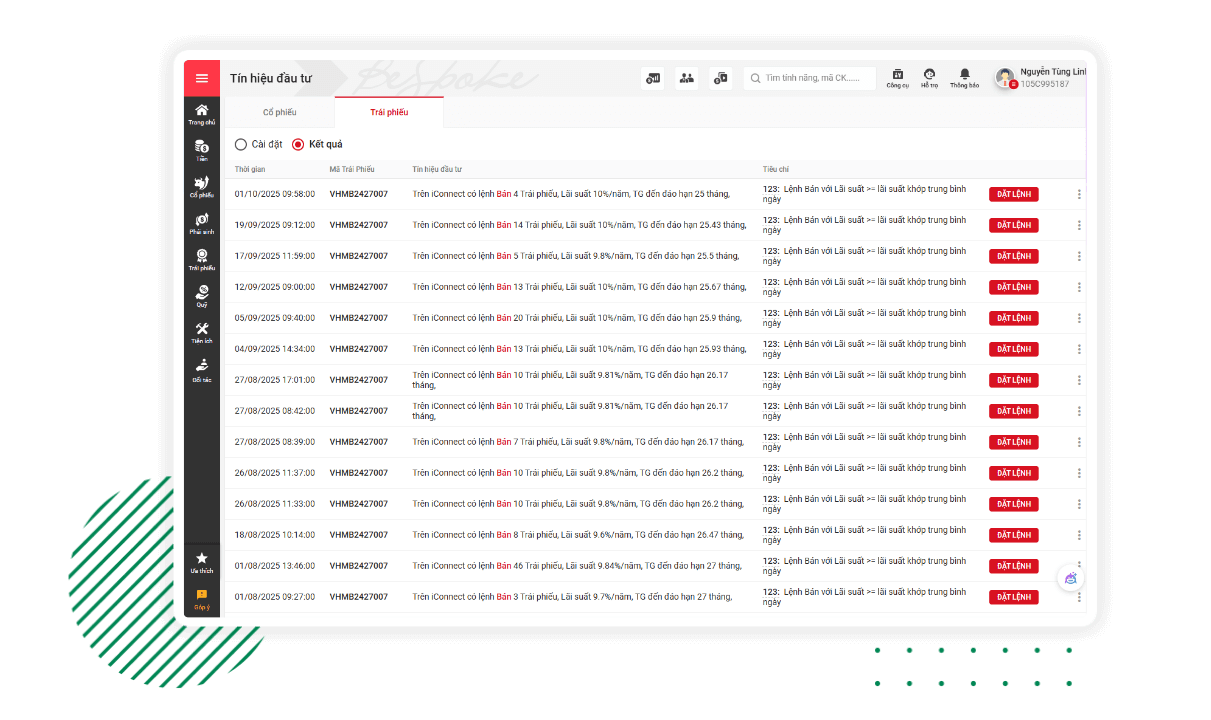

24/7 Bond Alert Feature

Stay ahead of the market with real-time bond alerts tailored to your needs:

- Set up personalized alerts by issuer, bond code, tenor, product line, or target yield

- Receive instant notifications when matching bonds appear, helping you make timely investment decisions

Save valuable time monitoring the market and never miss an opportunity again.

View guide

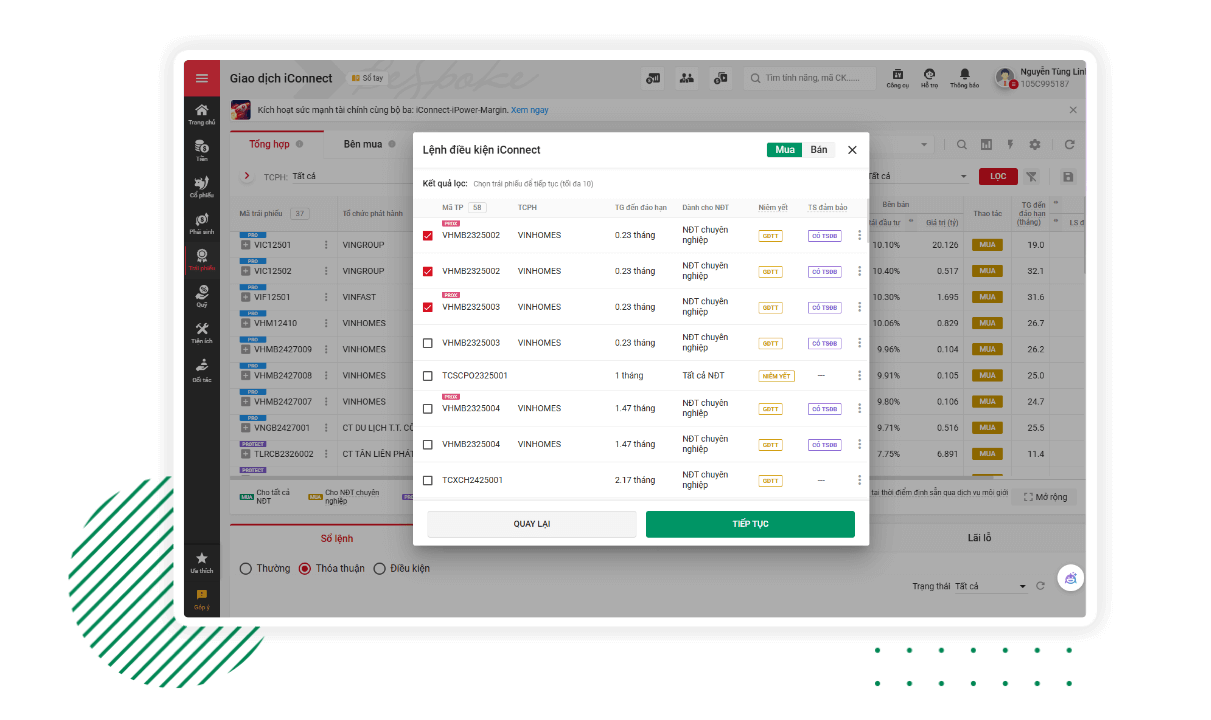

Conditional Order Placement on iConnect

With a single setup, your conditional order will be automatically executed once your criteria are met — ensuring you never miss the “golden moment” to optimize returns:

- Orders remain valid for up to 30 days

- Optimized cash flow: funds are not blocked until the order is triggered

- Diversification: place one order for up to 10 different bonds

- Fully personalized: customize by tenor, yield, issuer, and more according to your preferences

iConnectPro Brokerage Service

With iConnectPro, TCBS acts as your dedicated broker to help sell your bonds at pre-defined time points (e.g., after 3, 6, or 12 months) as agreed in your contract.

You also retain the flexibility to sell anytime directly on iConnect.

A flexible, secure, and 100% online solution — ensuring peace of mind while investing in long-term bonds.

View guide

Top-Traded Bonds on iConnect

Top 5 Most Traded Bonds (Last Week)

| Bond code | Coupon rate | Tenor group |

|---|---|---|

| VICH2325005 | 9.14% | 0-6 tháng |

| VACCB2426001 | 8.00% | 0-6 tháng |

| VIFCB2426001 | 10.40% | 12-18 tháng |

| VHM12410 | 11.00% | 24-30 tháng |

| VIF12501 | 11.25% | Trên 30 tháng |

Top 5 Highest-Yield Bonds by Tenor Group

| Bond code | Coupon rate | Tenor group |

|---|---|---|

| VICH2325005 | 9.14% | 0-6 tháng |

| VHMB2426004 | 10.10% | 6-12 tháng |

| VIFCB2426001 | 10.42% | 12-18 tháng |

| VHMB2427001 | 10.92% | 18-24 tháng |

| VHM12410 | 11.01% | 24-30 tháng |

Why Choose iConnect for Bond Investment?

iConnect is Vietnam’s pioneering online bond-trading platform and the largest in transaction volume nationwide — a trusted gateway where technology, transparency, and market leadership converge.

Globally Recognized by Leading Institutions

Ready to invest in bonds on iConnect with TCBS?

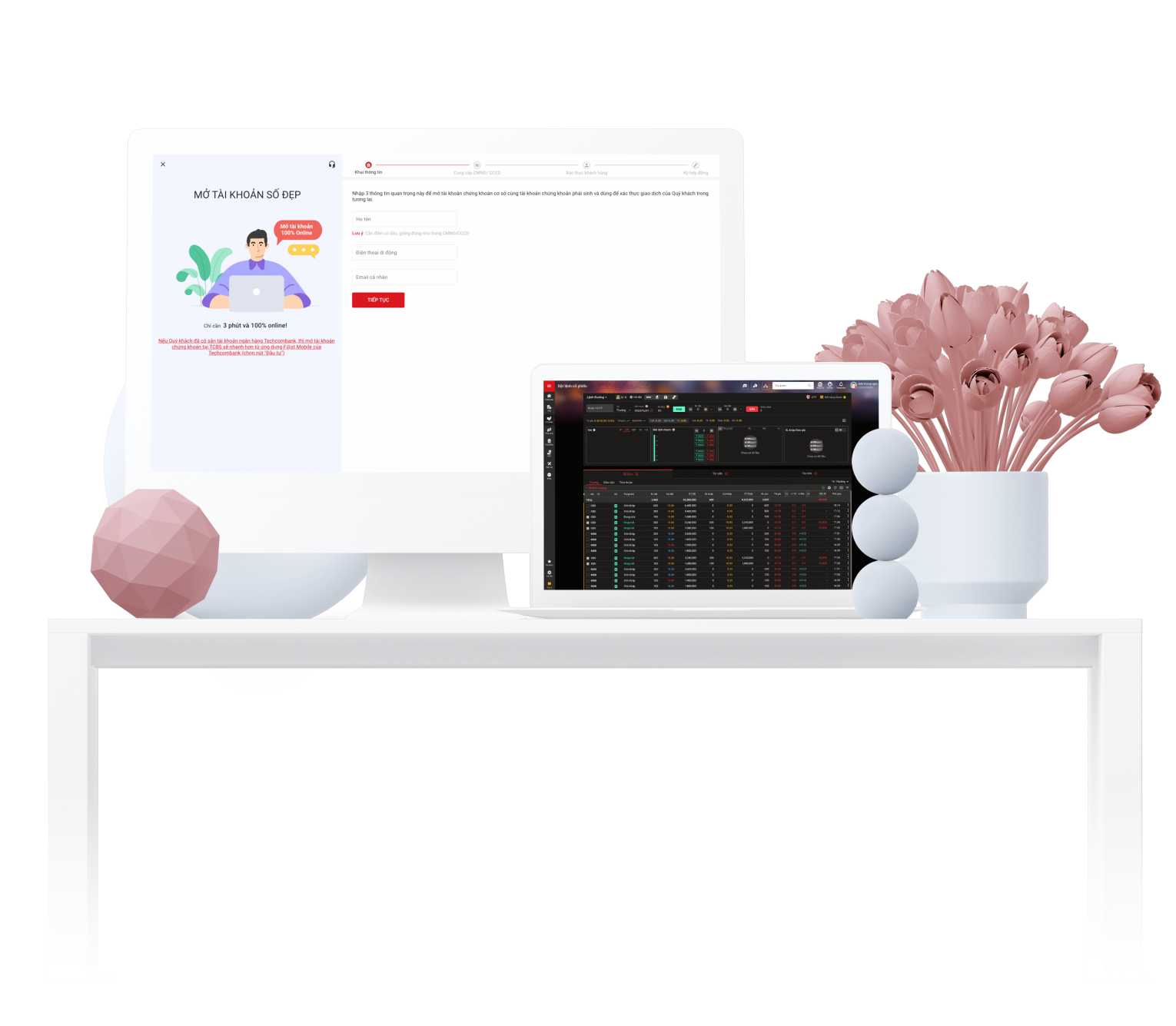

Step 1: Open an online account in just 3 minutes

Customers can open a Securities Account online via the TCInvest website https://tcinvest.tcbs.com.vn/

Step 2: Place an online Bond order

Select iConnect Trading section, then select the bond code to purchase

Frequently Asked Questions

What is the Par Value of a Bond?

The par value (or face value) of a bond is the value printed on the bond certificate. It serves as the basis for calculating the coupon interest that the issuer must pay to bondholders.

The par value also represents the amount the issuer must repay upon maturity.

Most bonds have a par value of VND 100,000 or VND 100 million.

What are the “Reinvested Yield” and “Non-Reinvested Yield” on iConnect?

- Reinvested Yield refers to the bond yield calculated by including interest earned from reinvesting the coupon payments received during the holding period, assuming a reinvestment rate of 5.5% per year.

- Non-Reinvested Yield represents the bond yield calculated only from the actual cash flows received by the investor, without reinvesting coupon payments.

How is the Bond Coupon Calculated?

Bond coupons are calculated using the following formula:

(coupon period end date – coupon period start date) * coupon interest rate * face value/365*(1 – Personal Income Tax (5%)).

For corporate clients, the personal income tax (PIT) deduction does not apply.

How is the Interest Rate Displayed on iConnect and How Does It Differ from the Coupon Rate?

The interest rate displayed on the iConnect quotation board always represents the buyer’s yield.

Based on this yield, the system automatically calculates the purchase price (the amount paid by the buyer) and the corresponding amount received by the seller.

The seller’s yield is shown as an annualized rate and is calculated as follows:

((Coupons received + Net sale proceeds after taxes and fees + Coupons to be received (if any)−Initial investment)/Initial investment)/Holding period * 365

Please note that the seller’s yield is only displayed after the investor clicks “Place Sell Order”, enters the number of bonds and desired selling price.

It is not displayed on the iConnect quotation board.

Can iBond be sold on iConnect?

Only Flexible demand iBond can be resold on the iConnect platform.